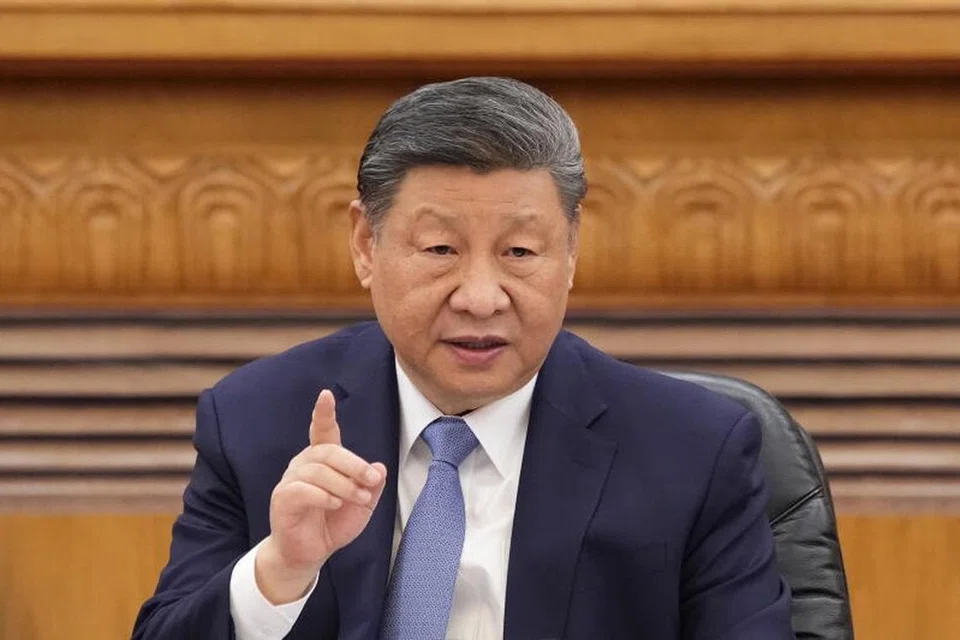

北京 —中國國家主席習近平決定對美國總統川普徵收大規模關稅採取迅速反擊措施,這向世界發出了一個明確的訊息:如果美國想打貿易戰,中國已經準備好應對。

經過數週的針對性措施回應和呼籲對話之後,中國於 4 月 4 日釋放了更強硬的態度,以徵收一攬子關稅和加強出口管制來回應川普的「對等」關稅。

隨後,共產黨官方報紙在 4 月 7 日發表社論宣稱,北京不再“抱持達成協議的幻想”,儘管它為談判留下了大門。

中國的堅決回應讓投資者做好了迎接長期且破壞性的貿易戰的準備。

4 月 7 日,川普進一步加深了這種擔憂,他威脅說,如果北京不撤回計畫中的報復性措施,中國將額外徵收 50% 的關稅。

據一位白宮官員透露,這項 50% 的徵收是在總統對所有中國進口產品徵收的 34% 關稅(將於 4 月 9 日起生效)以及他之前針對芬太尼販運徵收的 20% 稅款的基礎上徵收的。

川普也在社群媒體上警告稱,如果未來幾天不採取行動,美國將切斷與中國的所有會談和談判。

上海復旦大學美國研究中心主任吳心伯博士在談到中國的立場時表示:“我們認為,在坐下來談判達成協議之前,我們必須先戰鬥,因為對方想先戰鬥。”

在被問及川普與習近平通話的可能性時,吳小暉表示:“你剛剛打了我一巴掌,我不會只是打電話請求你的原諒。”

隨著中國面臨美國提高關稅(彭博經濟評論稱目前的稅率將基本抵消雙邊貿易)不可避免的現實,高層領導人正在加強提振國內經濟。

彭博新聞先前報道稱,政策制定者週末在北京開會,討論加快刺激消費的計劃,習近平希望藉助中國龐大的消費群體來吸收該國的製造業產出。

中國國家廣播電台 4 月7 日報稱,習近平呼籲加強「充分釋放」國家消費潛力,以刺激成長,但並未具體說明習近平何時何地發表了上述言論。

隨著世界最大經濟體之間的關係陷入螺旋式上升,人們對貿易戰對全球貿易影響的擔憂導致股市暴跌。

亞洲股市經歷了 2008 年以來最糟糕的一天。香港上市的中國股票指數陷入熊市,而香港基準恆生指數則出現 1997 年以來的最大跌幅。歐洲斯托克 600 指數一度下跌逾 6%。

壓力與自豪

緊張局勢的升級可能會使近期領導層通話的前景變得黯淡。川普自回到白宮後就沒有與習近平交談過,這是美國總統就職20年來最長的一次沒有與習近平交談的時間。

無黨派組織“保衛民主基金會”高級研究員克雷格·辛格爾頓表示:“特朗普和習近平陷入了壓力與驕傲的矛盾之中。” “但這裡有一個兩難的境地:如果習近平拒絕參與,壓力就會升級;如果他參與得太早,又有可能顯得太早。”

中國領導人正在走鋼索。他需要在國內展現實力,同時支持陷入通貨緊縮困境的經濟。

一個主要的挑戰是恢復消費者信心,持續多年的房地產市場低迷導致消費者大量財富流失,嚴重動搖了消費者信心。

瑞銀集團、高盛集團和摩根士丹利等幾家全球主要銀行上週末對美國百年來最大幅度上調關稅可能帶來的經濟影響發出警告。

他們警告稱,這些稅收可能會給中國本已不高的2025年經濟成長預測帶來更大壓力,目前的經濟成長率已低至4%,低於約5%的官方目標。

不斷增長的武器庫

儘管習近平已加大中國的反應力度,但仍未採取全面報復措施:如果與華盛頓的緊張局勢惡化,北京方面可以使用多種手段。

如果過去的行動可以作為借鑒的話,它可能會讓人民幣貶值,以抵消關稅的影響,加強對關鍵礦產的出口管制,或增加在華運營的美國企業的壓力。

中國還可以透過與其他地區建立更緊密的經濟聯繫來擴大其外交影響力。

今年3月,中國、日本和韓國的貿易官員聯合呼籲開放和公平的貿易。

中國財政部副部長廖岷最近訪問布魯塞爾時表示,願意與歐盟共同維護多邊貿易體制。中國駐渥太華大使館也表達了與加拿大建立合作的類似意願。

習近平預計本月稍後對東南亞的訪問具有更重要的意義。北京可能會關注柬埔寨、馬來西亞和越南等國家可能向華盛頓提出哪些關稅減免措施,以及這些措施是否會損害中國的利益。

尤索夫伊薩東南亞研究所高級研究員李淑安表示:“隨著美國和其他主要市場的需求收緊,其他經濟體將採取連鎖保護主義措施,以保護其產業免受中國廉價商品湧入的影響。”

儘管壓力加大,但沒有明顯跡象顯示中國正在尋求與美國徹底脫鉤。相反,它似乎正在堅持自己的立場,並為長期僵局做好準備,同時保留未來的選擇。

研究中國貿易政策的新加坡管理大學法學教授高亨利博士表示:“中國希望向美國傳達這樣的信息:中國不會被嚇倒,而且願意堅持自己的立場。” “其目標似乎不是造成重大損害,而是施加壓力並鼓勵對話。”

減少依賴

這次中國的信心來自於這樣一種信念:經過過去八年的積累,中國已經比川普第一次發動貿易戰時做好了更充分的準備。北京擴大了貿易夥伴網絡,減少了對美國的進出口依賴。

去年,美國佔中國出口的比重不到 15%,低於貿易戰爆發前 2017 年的 19%,不過透過第三國進行的貿易可能彌補了部分缺口。對中國來說,從美國進口的商品——本來就相對較少——不再那麼重要。

農產品就是一個典型的例子,中國正在尋求減少對美國大豆的依賴。曾經佔據中國市場主導地位的美國出口商去年的市佔率降至僅 20%,因為中國轉而增加了從巴西的採購量。

這一切或許能為中國贏得更多時間,直到雙方同意坐上談判桌。

中國人民大學國際關係學教授王義桅博士表示,中國預計川普的努力很快就會失去動力。

他向彭博社引用了一句中國古話:「當第一聲戰鼓響起時,士兵們最有戰鬥意志,但當第二聲戰鼓響起時,他們的鬥志就開始消退了。」 彭博

China’s Xi switches to fight mode as Trump trade deal looks unlikely

BEIJING - Chinese President Xi Jinping’s decision to quickly retaliate against US President Donald Trump’s sweeping tariffs sent the world a clear message: If the US wants a trade war, China is ready to fight.

After weeks of responding with only targeted measures and calling for dialogue, China signalled a tougher approach on April 4 by answering Mr Trump’s “reciprocal” tariffs with blanket duties of its own and more export controls.

The Communist Party’s official newspaper followed that up with an April 7 editorial declaring Beijing is no longer “clinging to illusions” of striking a deal, even as it leaves a door open to negotiations.

China’s defiant response has left investors bracing themselves for a prolonged and disruptive trade war.

Mr Trump deepened those worries on April 7, threatening an additional 50 per cent in tariffs if Beijing does not withdraw its planned retaliation.

The 50 per cent charge would come on top of the 34 per cent duty the president imposed on all Chinese imports – set to begin on April 9 – as well as a 20 per cent levy that he put in place earlier tied to fentanyl trafficking, according to a White House official.

Mr Trump also warned in a social media post that the US would cut off all future meetings and negotiations with China if action was not taken in the coming days.

“We believe that before we can sit down to negotiate a deal we have to fight, because the other side wants to fight first,” Dr Wu Xinbo, director at Fudan University’s Centre for American Studies in Shanghai, said of China’s stance.

On the possibility of a Trump-Xi call, Dr Wu said: “You just slapped my face, and I’m not just going to call you and beg your pardon.”

As China confronts the reality that rising US levies – now at a rate Bloomberg Economics says will mostly wipe out bilateral trade – are unavoidable, top leaders are ramping up efforts to bolster the domestic economy.

Policymakers huddled in Beijing over the weekend to discuss plans to accelerate stimulus to boost consumption, Bloomberg News reported earlier, as Mr Xi leans on China’s vast consumer base to help absorb the country’s manufacturing output.

Mr Xi has called for strengthened efforts to “fully unleash” the country’s consumption potential to spur growth, China’s state-run broadcaster reported on April 7, without specifying when and where he made those comments.

Stocks tumbled on concerns over the trade war’s impact on global trade, as relations between the world’s largest economies spiral.

Asia capped the worst day since 2008. A gauge of Chinese shares listed in Hong Kong fell into a bear market, while the city’s benchmark Hang Seng Index plunged the most since 1997. Europe’s Stoxx 600 tumbled more than 6 per cent at one point.

Pressure and pride

An escalation of tensions may dim the prospect of a leadership call in the near future. Mr Trump has not spoken to Mr Xi since returning to the White House, the longest a US president has gone without talking to his Chinese counterpart post-inauguration in 20 years.

“Trump and Xi are locked in a paradox of pressure and pride,” said Mr Craig Singleton, a senior fellow at the non-partisan Foundation for Defence of Democracies. “But here’s the dilemma: If Xi refuses to engage, the pressure escalates; if he engages too soon, he risks looking weak.”

The Chinese leader is walking a tightrope. He needs to project strength at home, while supporting an economy grappling with deflation.

A major challenge is restoring consumer confidence, which has been deeply shaken by a years-long housing slump that wiped out a significant chunk of their wealth.

Several major global banks – including UBS Group, Goldman Sachs Group and Morgan Stanley – sounded the alarm over the weekend about the potential economic fallout from the US’s steepest tariff hikes in a century.

They warned the levies could put more pressure on already modest 2025 growth forecasts for China, which are already as low as 4 per cent – below the official target of about 5 per cent.

Growing arsenal

While Mr Xi has ramped up China’s response, he still has not hit full retaliation: Beijing has several tools it could reach for if tensions with Washington worsen.

If past actions were any guide, it could let the yuan weaken to offset the impact of tariffs, tighten export controls on critical minerals or increase pressure on US companies operating in China.

China may also widen its diplomatic outreach by building stronger economic ties elsewhere.

In March, trade officials from China, Japan and South Korea jointly called for open and fair trade.

During a recent visit to Brussels, Chinese Vice-Finance Minister Liao Min expressed a willingness to work with the European Union to defend the multilateral trading system. The Chinese Embassy in Ottawa also made similar overtures about partnering with Canada.

Mr Xi’s expected visit to South-east Asia later this month takes on added importance. Beijing will likely be watching what countries like Cambodia, Malaysia and Vietnam might offer Washington in hopes of tariff relief, and whether those moves could undercut Chinese interests.

“What may be tougher for China to manage would be the knock-on protectionist measures other economies will take to shield their industries from an expected flood of cheaper Chinese goods as demand in the US and other key markets tighten,” said Ms Lee Sue-Ann, senior fellow at the ISEAS – Yusof Ishak Institute.

Despite the increased pressure, there is no clear sign that China is looking to fully decouple from the US. Instead, it seems to be asserting its position and bracing itself for a prolonged standoff, while keeping future options open.

“China wants to convey to the US that it is not intimidated and is willing to stand its ground,” said Dr Henry Gao, a law professor at Singapore Management University, who researches Chinese trade policies. “Rather than aiming to inflict significant damage, the goal seems to be to exert pressure and encourage dialogue.”

Reduced reliance

China’s confidence this time around stems from the belief that it is better prepared than it was during Mr Trump’s first trade war, having learned from the past eight years. Beijing has broadened its network of trade partners, reducing its dependence on the US for both imports and exports.

The US took less than 15 per cent of Chinese exports last year, down from 19 per cent in 2017 before the trade war, although trade routed through third countries likely made up for some of the shortfall. Imports from the US – already relatively small – have become less critical for China.

Agricultural products are a prime example, with China seeking to reduce its reliance on US soybeans. American exporters – which once dominated the Chinese market – saw their share fall to just 20 per cent last year as China ramped up purchases from Brazil instead.

All this may buy China more time until the two sides agree to meet at the negotiation table.

China expects Mr Trump’s efforts will run out of momentum soon, according to Dr Wang Yiwei, professor of international relations at Renmin University.

“Soldiers would be most willing to fight when the first battle drum sounds, but that begins to fade by the second round,” he told Bloomberg, citing an old Chinese saying. BLOOMBERG

沒有留言:

張貼留言

注意:只有此網誌的成員可以留言。