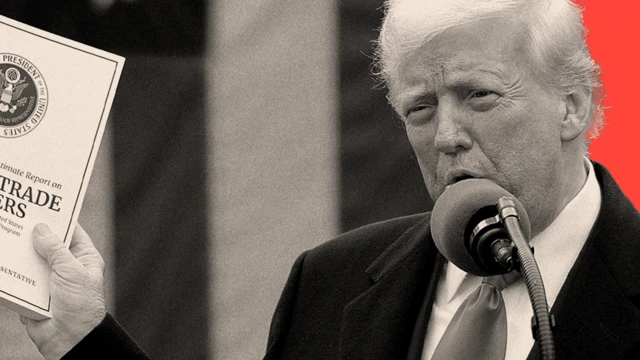

分析:特朗普关税背离美国经济繁荣的原有基石,后果可能很混乱

图像来源,Pool/BBC

- Author,费萨尔·伊斯兰(Faisal Islam)

- Role,BBC经济事务编辑

- Twitter,@faisalislam

美国总统特朗普又筑起了另一道围墙,他认为其他人都将买单。但这次,他实施的是对几乎所有进口产品征收至少10%的“对等关税”,这其实是

- 一道用来阻止工作和就业机会流失到国外的围墙,而非用来阻挡移民。

这道围墙的高度需要放在历史背景下来看待。它

- 将美国带回去一个世纪前的保护主义时代。

本周发生的事情不仅是

- 美国发起了一场全球贸易战,

而在这样做的同时,特朗普在白宫玫瑰园草坪上宣布关税政策时所使用的那套经济逻辑,不仅背离了经济学的基本原则,也违背了外交上的基本准则。

自由贸易大辩论

特朗在宣布关税政策时,多次提及

- 1913年。那是一个转捩点,当时美国开徵联邦所得税,同时大幅下调关税。

在此之前,

- 自美国建国之后,关税是美国政府的主要财政收入来源,

- 策略可追溯至首任财政部长亚历山大·汉弥尔顿(Alexander Hamilton)。

现任美国政府从这段历史中汲取的基本经验是:

- 高关税造就了美国,也让美国第一次伟大,而且还意味着不需要征收联邦所得税。

在大西洋彼岸,

- 支持全球化与自由贸易理念的,则是19世纪英国经济学家大卫·李嘉图(David Ricardo)的理论,

这套理论有数学公式支撑,但其基本概念其实相当容易理解:

- 各国因自然资源、人口的创造力等差异,在生产某些产品上各有所长。

广义上来说,如果每个国家都专注于自己最擅长的领域,然后进行自由贸易,那么整个世界以及每个国家本身的生活都会更好。

图像来源,Reuters

在英国,如今这仍是政治与经济交汇处的核心基石。现在世界多数国家仍然相信比较优势这个理论,这是全球化的核心思想。

但美国当年从未真正完全接受这套理论。美国潜在的抗拒态度从未消失。本周,

- 美国贸易代表创造了富有想像力的方程式,

“对等关税”背后的理据

这些所谓“对等关税”背后的逻辑值得去进行拆解,这些数字与各国实际公布的关税税率几乎没有关联。

白宫表示,这些数字已考虑了官僚体制与货币操纵等因素。但仔细观察那看似复杂的公式,其实不过是用来衡量该国对美国商品贸易顺差的简单方法:

- 他们将美国对该国的贸易逆差金额除以自该国的进口总额。

新闻发布会开始前一小时,一位白宫高级官员颇为公开地解释:

- “这些关税是由经济顾问委员会为每个国家量身计算的……他们所使用的模型,是基于这样的概念:

- 我们的贸易逆差,是所有不公平贸易行为、所有作弊总和的结果。”

这一点非常关键,根据白宫的说法,

- 如果一个国家对美国的出口多于从美国进口,那本身就会被视为是一种“作弊”的行为,

图像来源,Shutterstock

这也正是为什么会出现美国对那些几乎无人造访、只有企鹅栖息的小岛征收关税的超现实故事,这正正揭示了这项政策的真正计算方式。

该政策的长远目标,

- 是要将美国高达1.2兆美元的贸易逆差、以及与那些产生最大贸易赤字的国家的逆差额,压低至零。

- 目的并非针对那些有明确且可量化贸易壁垒的国家,

- 而是针对那些对美国有贸易顺差的国家。

虽然这两项因素有所交集,但它们并不是同一回事。

造成贸易顺差或逆差的原因非常多样,没有天生的理由支持贸易差异应该“归零”。不同国家擅长生产不同的产品,以及拥有不同的自然与人力资源,这些差异正是贸易存在的基础。

但美国现在似乎不再相信这一套。事实上,

- 如果将相同理据应用到服务贸易上,美国在金融服务、社群媒体科技等领域,对外拥有高达2,800亿美元(相等于2,160亿英镑)的顺差。

然而,服务贸易被排除了在白宫整套关税政策的计算中。

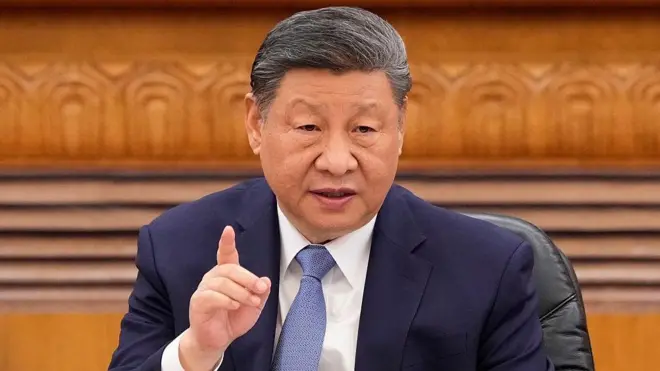

“中国冲击”和涟漪效应

这背后其实还有更深层的意义。正如

- 美国副总统JD·万斯(JD Vance)上个月在演说中所说,对于现届政府而言,

- 全球化之所以被认定为失败,

- 是因为当初的想法是“富裕国家将进一步提升价值链,贫穷国家则制造更简单的东西”。

但结果并非如此,尤其是在中国这个案例中。因此,美国正决意远离这种全球化模式。

对美国而言,

- 现在重要的已不是大卫·李嘉图,而是

- 麻省理工学院(MIT)经济学家大卫·奥托(David Autor),

- 他曾经提出“中国冲击论”(China shock)这个概念。

2001年,在全球聚焦于911事件的余波之际,

- 中国加入了世界贸易组织(WTO),能够相对自由地进入美国市场,从而改变了全球经济格局。

当中国的农村人口大规模迁往沿海工厂,为美国消费者生产更廉价的出口商品时,美国的生活水平、经济成长、利润与股市皆迎来繁荣的状态,这是一个“比较优势”正常运作的经典例子。

中国因此赚取了数兆美元,其中很大一部分又以购买美国国债的形式再投资回美国,有助将利率降低。

图像来源,Getty Images

每一个人都是赢家,但不完全是。基本上讲,美国消费者因为能买到更便宜的商品而集体变得更富有,但作为交换,美国失去了大量制造业,这转移到了东亚。

奥托的研究指出,

- 到2011年为止,这场“中国冲击”导致美国流失了约100万个制造业职位,总体而言失去了约240万个工作机会。

- 这些冲击主要集中在“铁锈地带”与南部地区。

这场贸易冲击对就业与工资造成的影响,持续了很长的一段时间。

奥托去年进一步更新他的分析,发现特朗普政府在第一任期所推行的关税保护主义虽然对整体经济的净影响有限,

- 但确实削弱了民主党在受影响地区的支持度,

- 同时在2020年总统大选中强化了特朗普的支持度。

时间回到本周,白宫内聚集了一群庆祝关税政策的汽车工会与石油天然气产业的工人。

他们所获得的承诺是,这些工作不仅会回流到“铁锈地带”,更将重返全美各地。某程度上,这是有可能实现。总统对外国企业所释出的明确讯息是,

- 若果想避免被征税,那就把工厂迁到美国来。

但总统将过去半世纪自由贸易的历程形容为

- 对美国的“强奸与掠夺”,

- 美国的服务业蓬勃发展,

- 美国的经济表现其实相当出色。

- 问题在于这些成果在不同产业之间分配不均,

- 而美国缺乏足够的财富重分配与转型配套措施,

- 导致这些经济成果未能平均分布全国各地。

- 这其实反映了美国的政治选择。

第一场社群媒体时代的贸易战

如今,随着美国透过一连串突如其来的保护主义措施,试图让制造业“回流”本土,其他国家也面临抉择:

- 是否仍然应该支持那些曾让美国致富的资本与贸易流动?

全球的消费者拥有选择权。

那些美国的蓝筹企业会面临巨大的问题,

- 这些公司过去依靠效率极高的东亚供应链,

- 透过低廉的成本进行生产,

- 再凭着具有吸引力的品牌形象在全球进行行销,

- 就像一部部现金印钞机。

如今它们的股价遭受重创,

- 一方面是美国总统重挫了它们的供应链策略,

- 另一方面,这也可能极大损害了其在全球消费者心目中的品牌形象。

图像来源,Shutterstock

最终,这是一场首度发生于

- 社群媒体的贸易战。

那些曾押注成为美国消费者工厂的国家也面临选择,新的经济联盟将会逐渐形成和深化,它们的目标是要寻求摆脱反复无常的美国。

总统对此显得尤为敏感,他威胁称,

- 如果欧盟和加拿大联手报复,他将提高关税。

在贸易战的游戏理论中,可信度非常关键。

- 美国拥有的无与伦比的军事与科技实力或许会有帮助,

- 任意、明显荒谬的公式来改写全球贸易规则,会容易激起其他国家的反弹。

尤其是当世界其他国家都认为美国总统手中的枪是瞄准他自己的脚的时候,情况更加如此。美国股市跌幅最多,而美国的通膨问题也将首当其冲。如今华尔街正在计算,

- 美国陷入经济衰退有超过一半的可能性。

也许这种理论不无道理,即其真正的目标是

- 削弱美元并降低美国的借贷成本。

目前,

- 美国正一步步退出它自己一手打造的全球贸易体系。

Trump has turned his back on the foundation of US economic might - the fallout will be messy

Pool/BBC

Pool/BBCPresident Donald Trump has built another wall, and he thinks everyone else is going to pay for it. But his decision to impose sweeping tariffs of at least 10% on almost every product that enters the US is essentially a wall designed to keep work and jobs within it, rather than immigrants out.

The height of this wall needs to be put in historical context. It takes the US back a century in terms of protectionism. It catapults the US way above the G7 and G20 nations into levels of customs revenue, associated with Senegal, Mongolia and Kyrgyzstan.

What occurred this week was not just the US starting a global trade war, or sparking a rout in stock markets. It was the world's hyper power firmly turning its back on the globalisation process it had championed, and from which it handsomely profited in recent decades.

And in so doing, using the equation that underpinned his grand tariff reveal on the Rose Garden's lawns, the White House also turned its back on some fundamentals of both conventional economics and diplomacy.

The great free trade debate

Trump talked a lot about 1913 in his announcement. This was a turning point when the US both created federal income tax and significantly lowered its tariffs.

Before this point, from its inception, the US government was funded mainly by tariffs, and was unapologetically protectionist, based on the strategy of its first Treasury Secretary Alexander Hamilton.

The basic lesson the White House has taken from this is that high tariffs made America, made it "great" the first time, and also meant that there was no need for a federal income tax.

On this side of the Atlantic, underpinning globalisation and free trade are the theories of 19th-Century British economist David Ricardo. In particular, the 1817 Theory of Comparative Advantage.

There are equations, but the basics are pretty easy to understand: Individual countries are good at making different things, based on their own natural resources and the ingenuity of their populations.

Broadly speaking, the whole world, and the countries within it, are better off, if everyone specialises in what they are best at, and then trades freely.

Reuters

ReutersHere in Britain this remains a cornerstone of the junction between politics and economics. Most of the world still believes in comparative advantage. It is the intellectual core of globalisation.

But the US was never a full convert at the time. The underlying reluctance of the US never disappeared. And this week's manifestation of that was the imaginative equation created by the US Trade Representative to generate the numbers on Trump's big board.

The rationale behind 'reciprocal' tariffs

It is worth unpacking the rationale for these so-called "reciprocal" tariffs. The numbers bear little resemblance to the published tariff rates in those countries.

The White House said adjustments had been made to account for red tape and currency manipulation. A closer look at the, at-first, complicated looking equation revealed it was simply a measure of the size of that country's goods trade surplus with the US. They took the size of the trade deficit and divided it by the imports.

In the hour before the press conference a senior White House official explained it quite openly. "These tariffs are customised to each country, calculated by the Council of Economic Advisers… The model they use is based on the concept the trade deficit that we have is the sum of all the unfair trade practices, the sum of all cheating."

This is really important. According to the White House, the act of selling more goods to the US than the US sells to you, is by definition "cheating" and is deserving of a tariff that is calculated to correct that imbalance.

Shutterstock

ShutterstockThis is why the surreal stories about the US tariffing rarely visited islands only inhabited by penguins matter. It reveals the actual method.

The long-term aim, and the target of the policy, is to get the US $1.2 trillion trade deficit and the largest country deficits within that down to zero. The equation was simplistically designed to target those countries with surpluses, not those with recognisable quantifiable trade barriers. It targeted poor countries, emerging economies and tiny irrelevant islets based on that data.

While these two different factors overlap, they are not the same thing.

There are many reasons why some countries have surpluses, and some have deficits. There is no inherent reason why these numbers should be zero. Different countries are better at making different products, and have different natural and human resources. This is the very basis of trade.

The US appears no longer to believe in this. Indeed if the same argument was applied solely to trade in services, the US has a $280bn (£216bn) surplus in areas such as financial services and social media tech.

Yet services trade was excluded from all the White House calculations.

'China shock' and the ripple effect

There is something bigger here. As the US Vice President JD Vance said in a speech last month, globalisation has failed in the eyes of this administration because the idea was that "rich countries would move further up the value chain, while the poor countries made the simpler things".

That has not panned out, especially in the case of China, so the US is moving decisively away from this world.

For the US, it is not David Ricardo who matters, it is David Autor, the Massachusetts Institute of Technology (MIT) economist and the coiner of the term "China shock".

In 2001, as the world was distracted by the aftermath of 9/11, China joined the World Trade Organisation (WTO), having relatively free access to US markets, and so transforming the global economy.

Living standards, growth, profits and stock markets boomed in the US as China's workforce migrated from the rural fields to the coastal factories to produce exports more cheaply for US consumers. It was a classic example of the functioning of "comparative advantage". China generated trillions of dollars, much of which was reinvested in the US, in the form of its government bonds, helping keep interest rates down.

Getty Images

Getty ImagesEveryone was a winner. Well, not quite. Essentially US consumers en masse got richer with cheaper goods, but the quid pro quo was a profound loss of manufacturing to East Asia.

Autor's calculation was that by 2011, this "China shock" saw the loss of one million US manufacturing jobs, and 2.4 million jobs overall. These hits were geographically concentrated in the Rust Belt and the south.

The trade shock impact on lost jobs and wages was remarkably persistent.

Autor further updated his analysis last year and found that while the Trump administration's first term dabble with tariff protection had little net economic impact, it did loosen Democrat support in affected areas, and boosted support for Trump in the 2020 presidential election.

Fast forward to this week, and the array of union car workers and oil and gas workers celebrating the tariffs in the White House.

So the promise is that these jobs will return, not just to the Rust Belt, but across the US. This is indeed likely to some degree. The president's clear message to foreign companies is to avoid the tariffs by moving your factories. The carrots offered by Biden followed by the stick from Trump could well lead to material progress on this.

But the president's characterisation of the past half century of freer trade as having "raped and pillaged" the US obviously doesn't reflect the overall picture, even if it has not worked for specific regions, sectors or demographics.

The US service sector thrived, dominating the world from Wall Street and Silicon Valley. US consumer brands used hyper-efficient supply chains stretching into China and East Asia to make incredible profits selling their aspirational American products everywhere.

The US economy did very well indeed. The problem, simply, was that it was not evenly distributed among sectors. And what the US lacked was levels of redistribution and adaptation to spread that wealth across the country. This reflects America's political choices.

The first social media trade war

Now, as the US chooses to reshore its manufacturing with a sudden jolt of protectionism, other countries also have choices as to whether to support the flows of capital and trade that have made the US rich.

The world's consumers have choices.

It is little wonder major blue chip American companies, which have built cash machines on hyper-efficient East Asian supply chains producing cheaply and then selling to the whole world based on their attractive aspirational brands, have a big problem.

Their share prices are particularly badly affected because the president has both decimated their supply chain strategies, and also risks greatly impairing their brand image amongst global consumers.

Shutterstock

ShutterstockUltimately, this is the first social media trade war. The experience of Tesla's sale slump and Canada's backlash against US goods may prove contagious. That would be as powerful as any counter-tariff.

These countries that bet on being the workshops for US consumers have choices over trade too. New alliances will form and intensify that seek to cut out an erratic US.

The president's sensitivity to this was apparent when he threatened to increase tariffs if the EU and Canada joined forces over retaliation. This would be the nightmare scenario.

In the game theory of trade wars, credibility does matter. The US has unrivalled military and technological might, which helps. But to transform the global trading system using an arbitrary formula, that throws up transparent absurdities, even without the penguins, is likely to encourage the other side to resist.

This is especially the case when the rest of the world thinks that the loaded gun that the president is holding is being aimed at his own foot. The stock market fell most in the US. Inflation will go up most in the US. It is Wall Street now calculating a more-than-evens chance of a recession in the US.

Perhaps there is some substance to the theory that the real objective here is to weaken the dollar and lower US borrowing costs.

For now, the US is checking out of the global trade system it created. It can continue without it. But the transition is going to be very messy indeed.

BBC InDepth is the home on the website and app for the best analysis, with fresh perspectives that challenge assumptions and deep reporting on the biggest issues of the day. And we showcase thought-provoking content from across BBC Sounds and iPlayer too. You can send us your feedback on the InDepth section by clicking on the button below.

沒有留言:

張貼留言

注意:只有此網誌的成員可以留言。